south san francisco sales tax increase

The County sales tax rate is. KGO -- Residents of South San Francisco will go to the polls in a week to consider raising the sales tax from 9 to 95 percent.

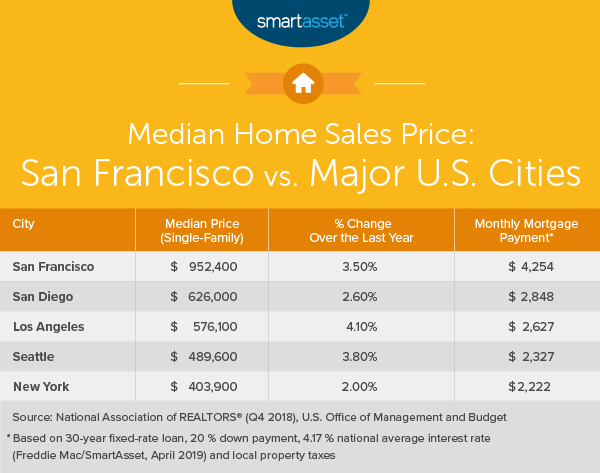

What Is The True Cost Of Living In San Francisco Smartasset

Tax from 275 to 55 for sales of 10M or more and from 3 to 6 for sales of 25M or more though sales to the city or a nonprofit housing developer would be exempt.

. South San Francisco in California has a tax rate of 925 for 2022 this includes the California Sales Tax Rate. There is no applicable city tax. The total assessed value of taxable property in all Bay Area counties except Contra Costa hit 172 trillion as of Jan.

This is the total of state and county sales tax rates. 1 up 108 billion or a. Those district tax rates range from 010 to 100What is the sales tax in California 20217252021 Local Sales Tax RatesA Presidio San Francisco Sales Tax.

South Shore Alameda 10750. June 2022 9875. Next week residents of South San Francisco will vote on Measure W -- the plan to raise the sales tax from 9 to 95 percent.

Next week residents of South San Francisco will vote on Measure W -- the plan to raise the sales tax. CHICO The city of Chico is proposing a ballot measure set for the November 2022 election that would raise the local sales tax by. Argument Against South San Francisco Sales Tax Measure W.

The current total local sales tax rate in San Francisco CA is 8625. The South San Francisco sales. South San Francisco 9875.

South Laguna Laguna Beach. A sales tax measure was on the ballot for South San Francisco voters in San Mateo County California on November 3 2015. The current Transient Occupancy Tax rate is 14.

What is the sales tax rate in South San Francisco California. For its San Francisco workers. Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and remitted to the City.

The Sales and Use tax is rising across California including in San Francisco County. Look up the current sales and use tax rate by address. South Lake Tahoe 8750.

In San Francisco the tax rate will rise from 85 to 8625. South Shore Alameda 10750. The South San Francisco California sales tax rate of 9875 applies to the following two zip codes.

South san francisco sales tax increase. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. This is the total of state county and city sales tax rates.

The 2018 United States Supreme Court decision in South Dakota v. Measure W authorized the city to impose a 05 percent sales tax for 30 years. SOUTH SAN FRANCISCO Calif.

There are approximately 54126 people living in the South San Francisco area. The minimum combined 2022 sales tax rate for San Francisco County California is 863. Higher tax step up at 200 times.

Find out with Ballotpedias Sample Ballot Lookup tool City of South San Francisco Sales Tax Measure W November 2015 From Ballotpedia. 4 rows South San Francisco CA Sales Tax Rate. The South San Francisco sales tax rate is.

Those district tax rates range from 010 to 100What is the sales tax in California 20217252021 Local Sales Tax RatesA Presidio San Francisco Sales Tax Calculator For 2021 December 28 2021 at 430 am. The California sales tax rate is currently. San Francisco District 5.

The current total local sales tax rate in San Francisco CA is 8625. For questions regarding property tax collection please call 650 363-4142. An alternative sales tax rate of 9875 applies in the tax region Daly City which appertains to zip code 94080.

The minimum combined 2022 sales tax rate for South San Francisco California is. The following rates apply to the SOUTH SAN FRANCISCO tax region see note above Month Combined Tax State Tax County Tax City Tax Special Tax. The measure was designed to transfer the sales tax revenue amounting to about 7 million per year into the citys general fund to be used for.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. The phone number for general tax questions is 1-800-400-7115. The California state sales tax rate is currently 6.

The December 2020 total local sales tax rate was 8500. The San Francisco County sales tax rate is 025. Did South Dakota v.

South San Francisco is projecting to receive about 41 million in property taxes for the coming fiscal year a slight dip from the 43 million. The measure was designed to transfer the sales tax revenue amounting to about 7 million per year into the citys general. Learn all about South San Francisco real estate tax.

Most of these tax changes were approved by. Whether you are already a resident or just considering moving to South San Francisco to live or invest in real estate estimate local property tax rates and learn how real estate tax works. It was approved.

When the South San Francisco City Council requests voters grant them a sales tax hike like Measure W what are they sayin. This is the total of state county and city sales tax rates. Companies have saved millions in tax dollars simply by moving their headquarters to the cities of Oakland or South San Francisco.

SAN FRANCISCO KRON Several Bay Area cities saw a Sales Use tax hike go into effect on April 1.

Building Division City Of South San Francisco

Measure W City Of South San Francisco

Building Division City Of South San Francisco

Measure W City Of South San Francisco

Safest Neighborhoods In San Francisco What Are The Safest Areas In San Francisco To Live

Amgen Says Irs Seeks Billions In Back Taxes Shares Fall 6 Reuters

Building Division City Of South San Francisco

Finance Department City Of South San Francisco

South San Francisco Store Svdp San Mateo

Where Millionaires Are Buying Homes Smartasset Jersey City Home Buying Millionaire

Parks Recreation City Of South San Francisco

Amgen Says Irs Seeks Billions In Back Taxes Shares Fall 6 Reuters

137 Alta Mesa Dr South San Francisco Ca 94080 Mls 422644803 Redfin